Oil Price Shocks and the Nigeria Economy: A Variance Autoregressive (VAR) Model

- GUNU UMAR

- KILISHI, A. ABDULHAKEEM

Abstract

Oil prices have been highly volatile since the end of World War II. The volatility becomes even more serious inrecent time. This has implications for the economies of oil exporting countries, particularly oil dependent

countries like Nigeria. The paper examined the impact of these fluctuations on macroeconomic of Nigeria.

Using VAR, the impact of crude oil price changes on four key macroeconomic variables was examined. The

results show that oil prices have significant impact on real GDP, money supply and unemployment. It impact on

the fourth variable, consumer price index is not significant. This implies that three key macroeconomic variables

in Nigeria are significantly explained by exogenous and the highly volatile variable. Hence, the economy is

vulnerable to external shocks. Consequently, the macroeconomic performance will be volatile and

macroeconomic management will become difficult. Diversification of the economy is necessary in order to

minimize the consequences of external shocks.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v5n8p39

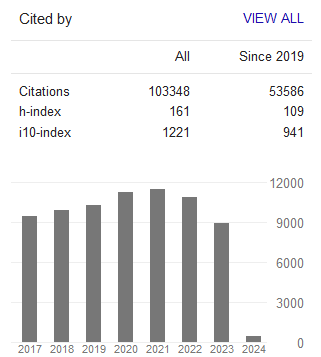

Journal Metrics

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org