A Probabilistic Internal Rate of Return: Theory and Illustration

- Samih Azar

- Nazim Noueihed

Abstract

The purpose of this paper is to provide a theoretical background on the internal rate of return (IRR), on theprobabilistic IRR, and to present an illustration based upon both a Taylor series expansion and a Monte Carlosimulation. It is shown that Monte Carlo simulation results in a more precise outcome as compared to thetheoretical expectations from a Taylor series expansion. This precision is more than twice in terms of thestandard deviations of the IRR, and around six times more in terms of the standard errors of the IRR. Second,the distributions of the internal rate of return follow approximately a normal distribution, and this allows asound basis for project appraisal and risk management. Third, the grand means of the internal rates of returns forall four cases considered are statistically insignificantly different from each other, as expected, and they arestatistically insignificantly different from the average internal rate of return, obtained by discounting the meanamounts of the cash flows. Fifth, the standard deviations and the standard errors of the IRR are directlyproportional to the assumed standard deviations of the cash flows.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v9n3p138

Journal Metrics

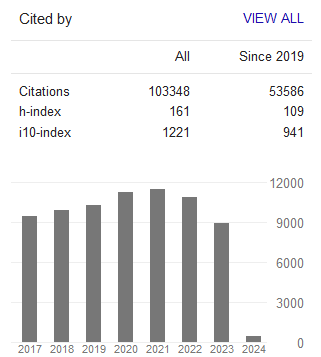

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org