The Impact of Firm Characteristics in Access of Financing by Small and Medium-sized Enterprises in Tanzania

- Alex Kira

- Zhongzhi He

Abstract

The contribution of Small and Medium-sized Enterprise (SME) sector in economic development, job creation

and income generation has been recognized worldwide. However, these contributions are not effectively

harnessed in Tanzania. The main challenge limiting the sector to contribute fully is a shortage of finance. This

study examines the impact of firm characteristics in access to debt financing by Tanzanian SMEs. The equation

specified access to finance as dependent variable while firm characteristics as independent variable. Data

collection was conducted through self-administered questionnaire in a survey of 163 Tanzanian firms. The

statistical analysis of data involved Pearson correlation and logistic regression to establish the association

between dependent and independent variables. The results indicate that firm’s location, industry, size, business

information, age, incorporation and collateral influence access to debt finance. The study recommends that

Tanzanian SME operators should maintain attractive firm attributes to stimulate lenders to extend debt financing

to their investments.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n24p108

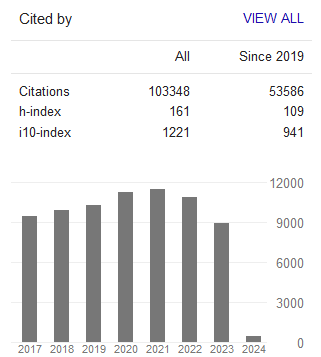

Journal Metrics

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org