Trends in Stock Prices and Range to Standard Deviation Ratio

- Subrata Kumar Mitra

Abstract

Hurst exponent (H) measured from R/S ratio, is being used as a measure to find predictability of a time series. Thelarger the H value, the stronger is the trending trait in the time series. In this paper, we estimated R/S ratio of

several stock indexes of Indian market for 10 years. Though the overall Hurst exponent values for the selected

series were close to 0.5, the value varied widely on period-to-period basis. The analysis of R/S ratio on a smaller

window size of 30 trading day revealed a positive relationship between R/S ratio and performance of a moving

average based trading rule.

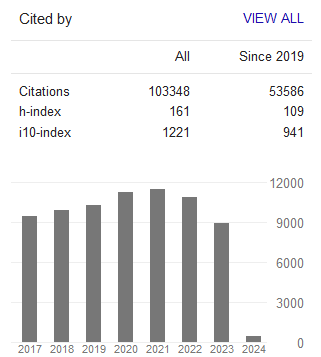

Journal Metrics

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org