Empirical Investigation on Repayment Performance of Amanah Ikhtiar Malaysia’s Hardcore Poor Clients

- Abdullah Al- Mamun

- Sazali Abdul Wahab

- C. A. Malarvizhi

Abstract

This study employs a cross sectional design with stratified random sampling method to examine the factors that

are associated with repayment problem encountered by clients of Amanah Ikhtiar Malaysia (AIM)’s microcredit

program. Findings of this study show that fungibility issue, number of gainfully employed members and number

of sources of income and household’s main economic activities are associated with repayment problems. AIM

therefore has to focus on advising the clients to use the credit in income generating activities. Policies should

also be reviewed and re-organized to increase employment rate and income generating opportunities among

client’s household members by providing appropriate training, diversifying the loan program and offering loans

for-non income generating activities.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v6n7p125

Journal Metrics

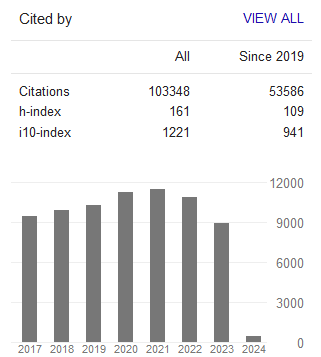

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org