Comparisons of PE and PB between SDB and Vanke A

- Feixue Huang

- Cheng Li

Abstract

Due to real estate and financial industry respectively characterized by strong and weak periodicity, this articleaiming to investigate which kind of cyclical industry in the listed companies will Price/Earnings (PE) and

Price/Book value (PB) be more suitable for evaluating selects the data of Shenzhen Development Bank (SDB)

and Vanke A from Feb. 28 1991 to June 30 2009, uses mean-variance comparison method and analyzes theirs

PE and PB. The results are that PE is more suitable for the evaluation of SDB and PB is more suitable for the

evaluation of Vanke A. It shows that to some extent PE is more suitable for the evaluation of weak cyclical

industry and PB is more suitable for the evaluation of strong cyclical industry.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v5n5p124

Journal Metrics

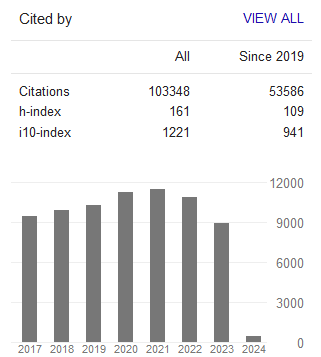

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org