Case Study: Helping Corporate Board Members Stay Diligent (Post Enron)

- Renee Pistone

Abstract

The Enron financial scandal impacted Wall Street and Board rooms within multinational corporations. Board Members need guidance in order to prevent fraud and abuse. The attorney featured in the following hypothetical faces serious ethical dilemmas. This hypothetical is unique because it involves an attorney Board Member facing ethical problems within a large business organization, as opposed to a one-on-one attorney-client situation. Here, the attorney Board Member, has a significant financial stake in the outcome. Certain issues will be delved into and analyzed according to customarily accepted Ethical standards for Board Members. Later on, this article is supplemented by federal and state case law. Supplemental cases were specifically chosen to emphasize and relay certain key principles of black letter law. Also, this article offers Board Members some reasonable alternatives to follow in order to follow due diligence.- Full Text:

PDF

PDF

PDF

PDF

- DOI:10.5539/ijbm.v5n5p51

Journal Metrics

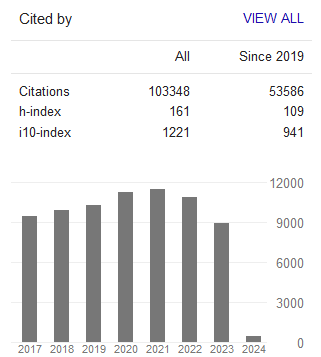

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org