Customer's Adoption for Technology-Enabled Delivery Channels in Selected Public Sector Banks

- Neha Gupta

- Vandana Tandon Khanna

Abstract

Purpose–The purpose of this paper is to investigate customer’s adoption for technology-enabled delivery channels such as Automated Teller Machines (ATMs), Internet banking, Tele-banking, mobile banking and branch lobby kiosks of selected Public Sector Banks (PSBs). In addition, the study consists of the customer’s willingness for adopting banks delivery channels and customer demographics influence on delivery channels in specific for Mumbai city (India).

Design/methodology/approach–For this study, structured questionnaire was administered to collect the primary data and random sampling method was adopted. The paper also presents a multi-year research effort on e-banking in delivery channels and suggests strategies to enhance the channelization of banking products and services through usage of delivery channels.

Findings–The findings reveal that the customer’s willingness for adoption of various technology-enabled delivery channels is lower than the banks’ acceptable level. The usage of technology-enabled delivery channels such as Automated Teller Machines (ATMs) and Internet banking is high in Mumbai. The results also show that the usage of mobile banking and branch lobby kiosks is very low. Most of respondents are using Internet banking for the purpose of fund transfer and account information. ATMs service is highly used among 36-45 years of age groups. Promoting awareness about benefit of technology-enabled delivery channels is of utmost important to increase usage of technology-enabled delivery channels.

Practical implications/limitations–The paper presents the opportunity for bank marketers to adapt to market orientated approach. They can consider customers usage pattern to increase the effectiveness of delivery channels. The results suggest that banks strategic and tactical activities require improvement in order to become more customer-focused and market-oriented. Furthermore, the scope of the study was selected PSBs’ customers residing in Mumbai city (India).

Originality/value–Previous studies that sought adoption of innovative delivery channels lack concern to user’s inclination to technology-enabled delivery channels. This paper makes a valuable contribution in the field of marketing strategy of banks, and evaluate to what extent consumers are ready to accept and use the products or the services introduced.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v10n12p215

Journal Metrics

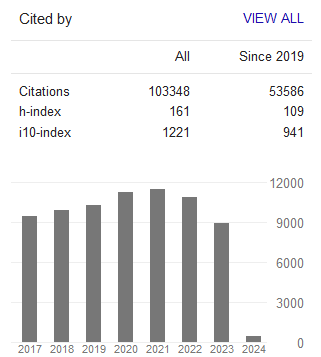

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org