Role of Accounting Conservatism on the Quality of Financial Statements

- Hamidreza Kordlouie

- Faramarz Mohammadi

- Nader Naghshineh

- Mehdi Tozandejani

Abstract

This study is an attempt at investigating the relationship between accounting conservatism and the quality offinancial statements of the companies accepted in Tehran Stock Exchange (TSE) market. Accountingconservatism is measured through GULIHINE model, while BIDEL, HILLARY, AND VERDI’s (2008) modelis used for assessing the financial statement quality. Through an experimental method, this study presents theconsumers of the accounting information—including market analysts, brokers, managers, and etc- the importanteffect of accounting conservatism on the financial statements of the companies.

Using the financial statement of 102 companies accepted in TSE market in a period of time, between 2006 and2010, it was apparent that there is a significantly positive relationship between accounting conservatism and thequality of financial reports.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v9n1p129

Journal Metrics

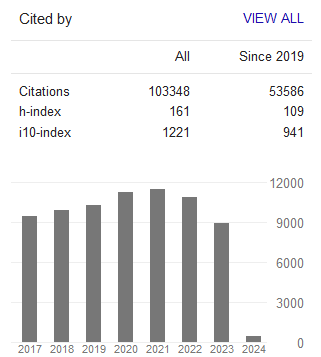

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org