Finance and Growth Nexus in Nigeria: Do Bank-Based and Market-Based Argument Matter?

- Augustine Ujunwa

- Ogbuagu Ekumankama

- Halidu Ahmad, Umar

- Mahmud Ibrahim, Adamu

Abstract

This paper contributes to the finance and growth debate by examining the channels through which bank and

market promote economic growth in Nigeria. The paper used 17 years time series data, 1992-2008, to fill this

knowledge gap. The formulated models were estimated with the Ordinary Least Square regression. The growth

rate of GDP per capita was adopted as the dependent variable, while bank size, bank activity, bank efficiency,

market size, market activity and market efficiency were adopted as the independent variables. The regression

coefficient for bank size, bank efficiency, market size and market efficiency were positive in promoting

economic growth. However, the coefficient of bank activity and market activity were negative in promoting

economic growth in Nigeria. The finding of the study relegates the financial structure arguments to the shadows,

and recommends for favourable macroeconomic environment that will allow for the development of the

financial system.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n23p112

Journal Metrics

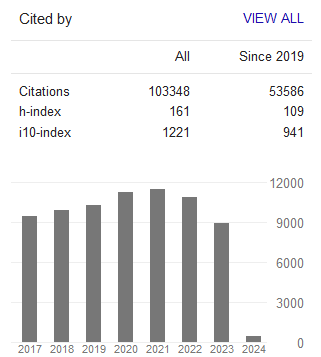

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org