The Choice of Foreign-Market Investment Modes: An Empirical Analysis Using Transaction-Cost and Organizational Learning Frameworks

- Thanh Phan

- Manh Vu

Abstract

In this study, we explain the foreign firm’s investment mode choice between international joint-venture (IJV) and

wholly owned subsidiary (WOS) by analyzing its intrinsic characteristics related to its assets contributed and

experiences on host country and the uncertainty of the local environment. Based on the logit regressions of 6603

investment mode decisions made by 5802 foreign investors in Vietnam during 1988 - 2008, our findings were

consistent with transaction-cost and organizational learning frameworks. We find positive associations between

highly specific assets and the stock of experience of foreign firms with their choice of WOS; so negative ones

with their choice of IJV as investment mode. Also, the IJV would be selected in a highly uncertain context; but in

a favorable one, the WOS is preferred by the foreign firm.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n15p14

Journal Metrics

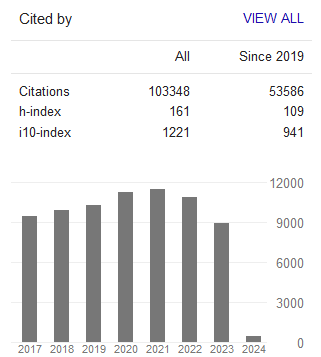

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org