Are Investment Strategies Exploiting Option Investor Sentiment Profitable? Evidence from Japan

- Chikashi TSUJI

Abstract

This paper demonstrates that the put–call ratio (PCR), an index of option investor sentiment, is useful for equity investment. More specifically, we find that monthly market timing strategies for the Nikkei 225 using the PCRs of Nikkei 225 index options are profitable, even after considering transaction costs. This evidence suggests that the PCR operates as a useful contrarian indicator for the underlying asset in Japan. Our analysis also reveals that application of the multivariate GARCH model in Japan is effective in predicting changes in the Nikkei 225 using the level of PCR.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v4n5p92

Journal Metrics

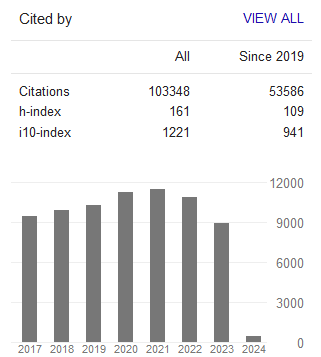

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org