A Study on Relationship between Shares-proportion of Institutional Investors and Corporation Performance----Based on the Dates of the Chinese listed Co.

- Linjuan Mu

Abstract

We have a study on relationship between shares-proportion of institutional investors and corporation performance during 2001 to 2005 in China. According to the positive analysis, we found the institutional investors have ability to choose the corporation which performance of them are markedly higher than which are not chosen by them. Moreover, from year of 2003, the more shares-proportion, the more corporation performance and the more restrict level to big shareholder, the more corporation performance are. Furthermore, the performance after the institutional investors investing exceeds the performance. So the institutional investors in China have value-creator characteristic. Development of the institutional investors to establish competition shareholder share structure and institutional investor union action then are advised.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v3n3p82

Journal Metrics

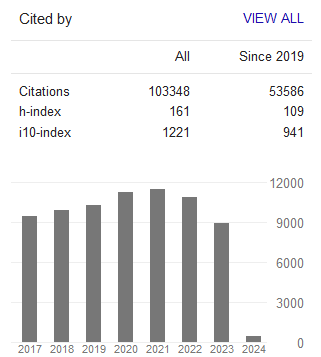

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org