Modelling Commercial Banks Liquidity Management Using Stochastic Programming

- Caston Sigauke

- Daniel Maposa

- Wifred Chagwiza

Abstract

In this paper a stochastic programming framework for liquidity management of commercial banks in Zimbabwe

is developed. The paper sets out to explain an important financial planning model for liquidity management; in

particular it discusses why in practice optimum planning models are used. The ability to build an integrated

approach which combines treasury security assets models with that of income generating decisions have proved

desirable and more efficient in that it can lead to better liquidity decisions. The role of uncertainty and

quantification of risk in these planning models is considered.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n9p49

Journal Metrics

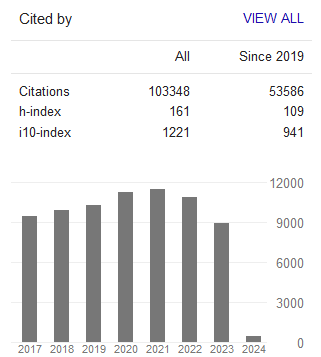

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org