Efficiency of Islamic and Conventional Banks in Pakistan: A Non-parametric Approach

- Muhammad Azeem Qureshi

- Madeeha Shaikh

Abstract

The purpose of this paper is to analyze comparative efficiency of banking system in Pakistan comprising of Islamic

banks (IB), conventional banks with Islamic banking division (IBD) and conventional banks (CB). For this

purpose we use two methods: First, ratio analysis to analyze cost, revenue and profit efficiency; Second, data

envelopment analysis (DEA), for comparative analysis of banks’ technical, pure technical and scale efficiencies.

We use efficiency scores of DEA to analyze the impact of size on the efficiency. Finally, we compare and contrast

the efficiency estimates with the traditional measures of banks efficiency. We find that Islamic bank is more cost

efficient and less revenue efficient. Considering their growth rate which is rudiment to scale efficiency (SE) we

argue that Islamic banks should be encouraged to reach the efficient frontier in the banking industry by reducing

their wastes. We further observe that hybrid banking may not be feasible form for banking industry in Pakistan. In

view of the observed inverse relationship of size with scale efficiency we recommend reconsideration of the

regulators’ policy of increasing the capital base of the banks thus forcing them to increase their size.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n7p40

Journal Metrics

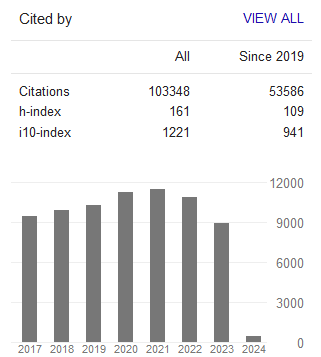

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org