Weak-Form Efficiency of Foreign Exchange Market in the Organisation for Economic Cooperation and Development Countries: Unit Root Test

- Juliana Ibrahim

- Yasmiza Long

- Hartini Ab. Ghani

- Safrul Izani Mohd Salleh

Abstract

This paper will look at the weak-form efficiency of the foreign exchange market in thirty (30) Organization forEconomic Cooperation and Development (OECD) countries. We employ Augmented Dickey-Fuller (ADF),

Philip-Perron (PP) and Kwiatkowski-Phillips-Schmidt-Shin analysis to examine for the unit root. Using weekly

data for the period 2000 to 2007, the results for weak-form efficiency using ADF and PP tests indicate that the

exchange rates studied follow random walks. The current value of the exchange rate cannot be predicted using its

past values. In addition, the OECD foreign exchange market consistent with the weak-form of the Efficient Market

Hypothesis.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v6n6p55

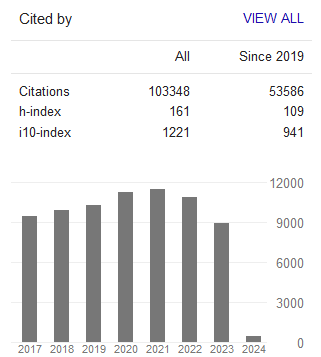

Journal Metrics

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org