Conservatism and Accruals: Are they Interactive? Evidence from the Greek Capital Market

- Panagiotis E. Dimitropoulos

Abstract

A large body of accounting research in the past has documented the existence of conservatism and timeliness of income recognition as distinct factors which affect the returns-earnings relation. However, earnings are not the only measure of financial performance that is affected by conservatism. The aim of this paper is to examine the impact of conservatism on accrual measures and drivers, in the Greek capital market between 1998 and 2004. Results indicated that conservatism has a significant impact on accrual measures (Total and non-discretionary accruals) but not on accrual drivers (earnings, sales, change in sales and property, plant and equipment). These findings suggest that common accrual models are misspecified, thus future research must consider the impact of conservatism in accrual models.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v3n10p113

Journal Metrics

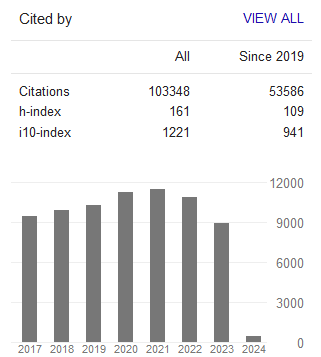

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org